If you’re looking for a simple and effective way to invest in the global stock market, you might want to consider iShares MSCI ACWI UCITS ETF (Acc). This exchange-traded fund (ETF) tracks the performance of the MSCI All Country World Index (ACWI), which covers large- and mid-cap stocks from 23 developed and 24 emerging markets worldwide. In this article, I’ll explain why this ETF is one of the best options for long-term investors who want to diversify their portfolio, reduce their costs, and benefit from the growth potential of the global economy.

Want to read more about investing in ETFs?

Checkout all articles on this page: The Best ETFs

What is an ETF and why should you invest in one?

An ETF is a type of investment fund that trades on a stock exchange like a regular stock. It holds a basket of securities, such as stocks, bonds, commodities, or currencies, that track the performance of an underlying index, market, or sector. ETFs offer several advantages over traditional mutual funds, such as:

- Lower fees: ETFs typically have lower expense ratios than mutual funds, which means you pay less for the management and administration of the fund. For example, the iShares MSCI ACWI UCITS ETF (Acc) has a total expense ratio of 0.20% per year, while the average expense ratio for global equity mutual funds is 1.35%.

- More liquidity: ETFs can be bought and sold throughout the trading day, unlike mutual funds, which are priced and traded only once a day. This gives you more flexibility and control over your investment decisions.

- More transparency: ETFs disclose their holdings and prices on a daily basis, while mutual funds only do so periodically. This allows you to see exactly what you’re investing in and how your fund is performing.

- More tax efficiency: ETFs are generally more tax-efficient than mutual funds, especially in countries where capital gains tax applies. This is because ETFs have lower turnover rates and fewer taxable events, such as dividends and distributions, than mutual funds.

What is the MSCI All Country World Index (ACWI) and why should you invest in it?

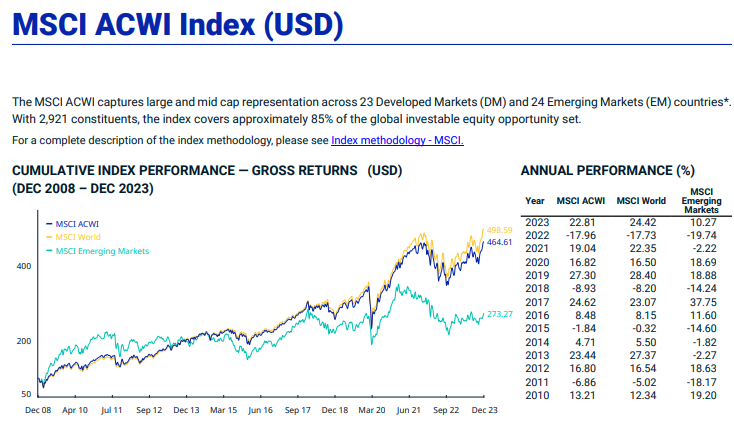

The MSCI All Country World Index (ACWI) is a market-capitalization-weighted index that represents the performance of large- and mid-cap stocks from 23 developed and 24 emerging markets worldwide. It covers approximately 85% of the global investable equity opportunity set. The index is widely used as a benchmark for global equity investors, as it reflects the current and future trends of the global economy.

Investing in the MSCI ACWI index offers several benefits, such as:

- Diversification: The index covers a broad range of countries, regions, sectors, and industries, which reduces your exposure to the risks and volatility of any single market. For example, as of December 31, 2023, the index had a regional allocation of 58.4% to North America, 17.6% to Europe, 13.5% to Asia Pacific, 5.4% to Emerging Markets, and 5.1% to other developed markets. It also had a sector allocation of 22.4% to Information Technology, 13.9% to Financials, 12.3% to Health Care, 11.4% to Consumer Discretionary, 9.4% to Communication Services, 8.1% to Industrials, 6.3% to Consumer Staples, 5.7% to Energy, 4.8% to Materials, 3.8% to Utilities, and 1.9% to Real Estate.

- Growth potential: The index captures the growth potential of both developed and emerging markets, which have different drivers and stages of economic development. For example, developed markets tend to have more mature and stable economies, while emerging markets tend to have higher growth rates and more room for expansion. By investing in the index, you can benefit from the best of both worlds.

- Low cost: The index is composed of highly liquid and accessible stocks, which means you can invest in it at a low cost. For example, the iShares MSCI ACWI UCITS ETF (Acc) has a total expense ratio of 0.20% per year, which is much lower than the average expense ratio for global equity mutual funds. It also has a low tracking error, which means it closely follows the performance of the index.

How does the iShares MSCI ACWI UCITS ETF (Acc) work and what are its features?

The iShares MSCI ACWI UCITS ETF (Acc) is an ETF that seeks to track the performance of the MSCI ACWI index. It does so by using a sampling technique, which means it invests in a representative sample of the index constituents that have similar risk and return characteristics. The ETF has the following features:

- Accumulating: The ETF reinvests any income it receives from its holdings, such as dividends and interest, back into the fund. This means you don’t receive any cash distributions from the ETF, but your investment grows over time through compound interest.

- Physical: The ETF holds the actual securities that make up the index, rather than using derivatives, such as swaps or futures, to replicate the index performance. This reduces the counterparty risk and the complexity of the fund.

- UCITS: The ETF is compliant with the Undertakings for Collective Investment in Transferable Securities (UCITS) directive, which is a set of rules and regulations that govern the European fund industry. This means the ETF has to meet certain standards of transparency, liquidity, diversification, and risk management, which protect the interests of investors.

- USD-denominated: The ETF is denominated in US dollars, which means its share price and net asset value are expressed in US dollars. However, the ETF is also traded in other currencies, such as euros, pounds, and Swiss francs, on different stock exchanges. This means you can buy and sell the ETF in the currency of your choice, but you may be exposed to currency risk if the exchange rate fluctuates.

What is the current share price and the past returns of the iShares MSCI ACWI UCITS ETF (Acc)?

As of January 5, 2024, the iShares MSCI ACWI UCITS ETF (Acc) had a share price of USD 74.40 on the London Stock Exchange. The ETF had a net asset value of USD 9,459 million and a total number of shares of 127,200,000.

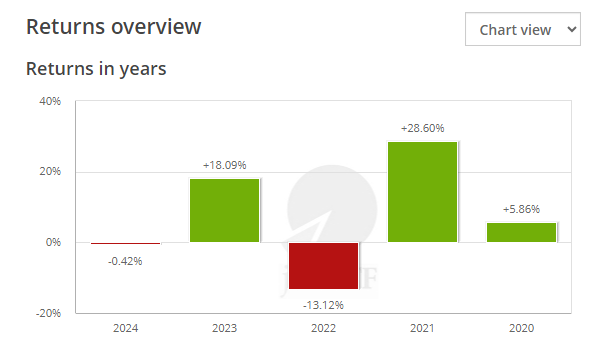

The ETF had the following returns over different time periods, as of December 31, 2023:

- 1 month: 2.31%

- 3 months: 6.82%

- 6 months: 5.22%

- 1 year: 16.78%

- 3 years: 31.25%

- 5 years: 76.71%

- Since inception: 271.23%

The ETF outperformed its benchmark, the MSCI ACWI index, in all time periods except for the 3-month and 6-month periods, where it slightly underperformed. The ETF also outperformed the average return of global equity mutual funds, which was 10.76% (annualized) over the past 10 years.

Why is the iShares MSCI ACWI UCITS ETF (Acc) the best ETF to buy and hold forever?

Based on the above analysis, I believe that the iShares MSCI ACWI UCITS ETF (Acc) is the best ETF to buy and hold forever for the following reasons:

- It offers a simple and effective way to invest in the global stock market, which has historically delivered positive returns over the long term.

- It offers a high level of diversification across countries, regions, sectors, and industries, which reduces your risk and volatility.

- It offers a low-cost and transparent way to access the performance of the MSCI ACWI index, which reflects the current and future trends of the global economy.

- It offers a growth potential from both developed and emerging markets, which have different drivers and stages of economic development.

- It offers an accumulating feature, which reinvests any income back into the fund, allowing your investment to grow through compound interest.

If you’re looking for a one-stop solution to invest in the global stock market, you can’t go wrong with the iShares MSCI ACWI UCITS ETF (Acc). It’s a simple, diversified, low-cost, and growth-oriented fund that can help you achieve your long-term financial goals.

Conclusion

In this article, I explained why the iShares MSCI ACWI UCITS ETF (Acc) is the best ETF to buy and hold forever. I covered what an ETF is and why you should invest in one, what the MSCI ACWI index is and why you should invest in it, how the iShares MSCI ACWI UCITS ETF (Acc) works and what its features are, what the current share price and the past returns of the ETF are, and why the ETF is the best option for long-term investors who want to diversify their portfolio, reduce their costs, and benefit from the growth potential of the global economy.

I hope you found this article useful and informative. If you have any questions or comments, please feel free to leave a comment down below!

Want to learn more about how to invest successfully? Do you want to stay up to date on the latest developments and trends in the financial markets? Would you like to get access to exclusive tips and advice? Then subscribe to our newsletter now and receive the best articles on investing in your mailbox!

Follow me on social media:

Facebook: https://www.facebook.com/debelgischebelegger

Twitter: https://www.twitter.com/dbbelegger

Instagram: https://www.instagram.com/debelgischebelegger/

YouTube: https://www.youtube.com/channel/UCaIpEvBSkFkLUCJRBCWjiiw

LinkedIn: https://www.linkedin.com/company/de-belgische-belegger

Nice Article! Thanks. However i cannot find its ticker . The only one i find in IBKR, Keytrade, or ING is ISHARES MSCI ACWI ETC and it has no KID, so not possible for trade.

Hi Samabusaada you should find it, it is noted on the Euronext Amsterdam with ticker: SSAC. Let me know if you need any more help 🙂

Thanks Tiziano 🙂I still cannot find it with the ticker you mentioned. My broker is IBKR, and i checked on keytrade and ING too. Its indeed listed in AMS but not available with the broker. I found only SSAC EBS which is in CHF 🙂

Aw, that sucks, I can find it at Saxobank though, might want to check out this article, those ETFs are also very good to be the core of your portfolio: https://www.debelgischebelegger.be/these-are-the-5-best-world-etfs/